What Does Strata Insurance Cover in SA?

Strata insurance covers the building and common property around the building. In cases where the strata title includes multiple buildings, strata insurance will include coverage for each building and the common spaces in between.

In South Australia, it is a legal requirement for strata corporations to maintain strata insurance for adequate financial and liability protection against unexpected building damage, loss, or accidents.

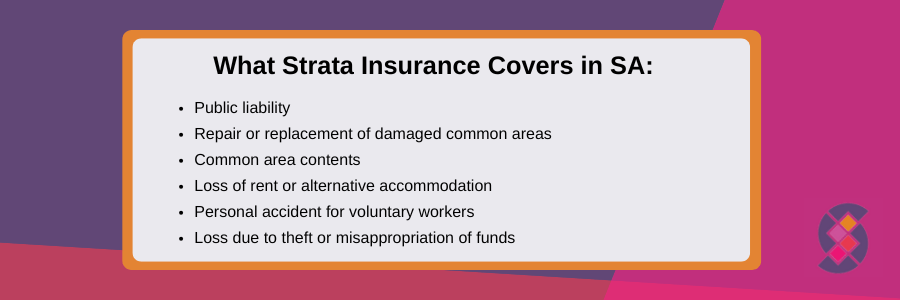

Here’s what’s covered under strata insurance in South Australia:

What Strata Insurance Covers in SA

Public liability

Public liability protects the strata corporation in the event that someone is injured on common property or if personal property is damaged as a result of an accident. Examples where public liability may apply include an unmarked wet hallway that causes a resident to slip and fall, or a broken pipe that falls onto a resident’s car. Public liability coverage may include legal costs, compensation payments, and medical bills, depending on the cause of the accident.

Repair or replacement of damaged common areas

Strata insurance covers the cost of repairs or replacement of damage to common areas due to a storm, fire, or vandalism. Common areas may include:

- Carparks

- In-ground swimming pools and sauna facilities

- Garden areas and sheds

- Driveways within the strata boundary

- Building walls, gates, and structural fixtures

The coverage extended across items and areas will depend on what is considered common property based on each strata property’s plan.

Common area contents

Strata insurance may include contents found in common areas, provided these are listed in the strata title or defined as common property. Common area contents can include:

- Furniture, equipment, and valuables

- Portable washers and dryers in shared laundries

- Gardening equipment or cleaning equipment

Coverage will only apply if the corporation owns the item; items left by residents in common areas are not covered.

Loss of rent or alternative accommodation

Where a property becomes uninhabitable due to an insured event, strata insurance can include support for rental income loss or temporary accommodation. For property owners with tenants, the policy may include compensation for the lost rent during the repair period. For those living in their unit, temporary accommodation costs may be covered.

Short-term rental arrangements, such as holiday rentals, are usually excluded from strata insurance coverage.

Personal accident for voluntary workers

Residents who perform unpaid work in the interest of contributing to the strata community (such as gardening work or administration tasks) are considered to be voluntary workers. Strata insurance provides personal accident cover if someone is injured while performing volunteer work, potentially covering costs such as medical treatment, temporary loss of income, and, in some cases, longer-term injury compensation.

Loss due to theft or misappropriation of funds

Strata insurance also offers protection against financial loss due to theft or, when funds handled by someone acting on behalf of the corporation are misused. This commonly includes the misuse of strata levies for unauthorised payments by a strata committee member or strata manager.

Optional Strata Insurance Coverage

Most strata insurance policies will offer optional add-ons to provide additional protection where required.

Liability for Office Bearers

Strata insurance can provide coverage for Office Bearer in respect of legal liability for any claims made against them. This coverage is designed to protect the strata committee who are acting in good faith, but may be facing legal consequences due to decision-making.

Machinery breakdown

Machinery breakdown coverage provides funds for repairs and replacements if equipment in the strata property breaks down unexpectedly. Strata machinery may include lifts, automatic doors, and water pumps.

Catastrophe cover

Catastrophe cover protects against increased costs due to large-scale natural disasters such as floods, bushfires, and earthquakes that can cause significant damage to a strata building. In addition to rebuilding costs, catastrophe cover may also provide support for affected residents to access temporary accommodation.

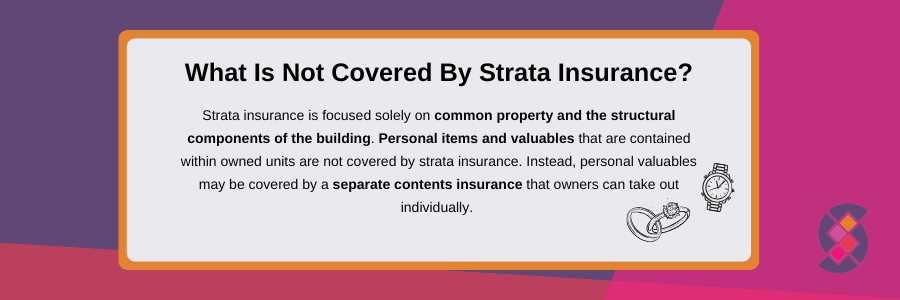

What Is Not Covered By Strata Insurance

Strata insurance is focused solely on common property and the structural components of the building. Personal items and valuables that are contained within owned units are not covered by strata insurance. Instead, personal valuables may be covered by a separate contents insurance that owners can take out individually.

Strata Insurance Regulations in South Australia

In South Australia, the requirement for strata insurance is covered by the Strata Titles Act 1988 and the Community Titles Act 1996. South Australia’s strata laws require each Body Corporate to hold insurance for the full replacement and reinstatement value of all buildings and shared property, public liability, as well as fidelity cover.

Who Is Responsible For Obtaining Strata Insurance?

The Body Corporate is responsible for taking out and maintaining strata insurance for the title. The cost of strata insurance is shared between all owners in the title, and is typically included in the strata levies that owners pay. While owners do not need to manage the policy directly, it is still worth reviewing the terms to understand what is and is not covered.

Alternatively, the Body Corporate can enlist the services of a strata management company to review strata insurance policies and provide you information and in some cases general advice. Strata management companies in SA like Strata Data help to simplify the decision-making process for strata insurance and ensure that the policy is compliant with South Australia’s regulations. We have over 40 years of experience delivering high-quality body corporate services and an in-house team of expert insurance managers – get in touch with us today to find out more about our strata insurance solutions.

Please note: The legislation on holding insurance, and which entity is responsible for holding said insurance can vary. This article is a guide to this area of insurance only. Any information in this article is general information only. Before making a decision to acquire any product(s) or to continue to hold any product we recommend that you consider whether it is appropriate for your circumstances.